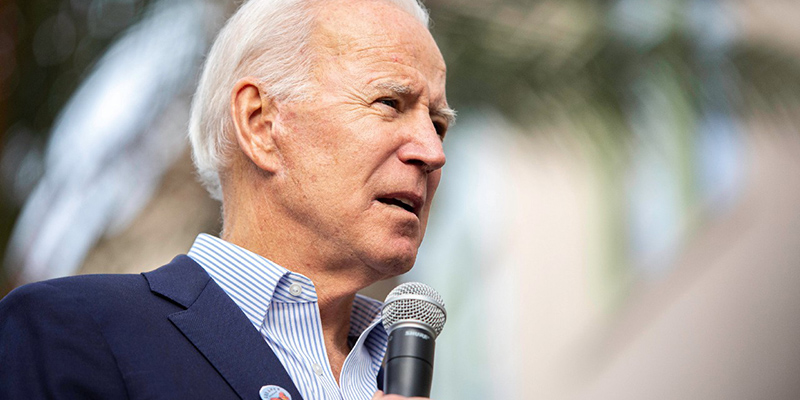

Bidens Housing Plan: What Is It About?

The housing market is abuzz about the recent unveiling of Bidens housing plan. But, what does this plan even entail? And how will it affect homeowners associations?

Browse By Category

Sign up for Our Newsletter

The housing market is abuzz about the recent unveiling of Bidens housing plan. But, what does this plan even entail? And how will it affect homeowners associations?

What Is Bidens Housing Plan?

It is no secret that the housing market in the United States has been going through some hardships. With the announcement of the Biden housing plan in May, many Americans and institutions have been looking forward to the changes that it is set to bring.

President Biden reiterated that his administration’s top economic priority is handling inflation. The housing plan he released, titled the Housing Supply Action Plan, is a direct response to that. The plan is designed to lower the burden of housing costs over time. It aims to achieve this through an increase in quality housing supply in each community.

For the past 5 years, America has experienced a shortfall in housing supply. Through the legislative and administrative actions enclosed in the plan, the Biden-Harris administration intends to close this gap. It all begins with the creation and preservation of affordable housing units, which the plan aims to accomplish within the next 3 years.

Additionally, the plan has a goal of making homeownership and renting more affordable for Americans. The plan will do this through the availability of rental and downpayment assistance. Rental costs are skyrocketing with each passing year, and Bidens housing plan will help address this problem, particularly for low- to moderate-income families.

Three Aspects That Matter to Homeowners Associations

To date, the Biden new housing policy is one of the most comprehensive plans tackling housing. But, not all of the details of the plan will affect homeowners associations. There are three elements, in particular, that will, though: preserving existing housing, zoning reforms, and limiting investor purchases of foreclosed properties.

Preserving Existing Housing

The new Biden housing policy aims to preserve the existing supply of rental homes by providing federal loan guarantees. While the proposal only targets rental housing, experts in the HOA industry believe this action must also extend to aging housing cooperatives and condominiums. This is so that homeownership in America will receive the same protection.

Community Associations Institute (CAI) is specifically supporting the Securing Access to Financing for Exterior Repairs (SAFER) in Condos Act. After what happened to the Surfside condominium in Florida, repairs have become more essential than ever, especially for aging condominiums. But, structural repairs are not exactly affordable. Condominiums and housing cooperatives will need financial assistance from the federal government to ensure the structural safety of their buildings.

Compared to single-family homes, condos and cooperatives are far less expensive to purchase. As such, CAI believes this should be a chief concern of the Biden administration as well, particularly in terms of preserving existing housing under the new housing plan.

Zoning Reform

Home and apartment construction just isn’t what it used to be. Due to shortages and a clog in the supply chain, developers have not been able to construct new homes at the same rate as in previous decades. Because of the shortfall in supply, renters and homebuyers have fewer options to choose from. And these options don’t come cheap, as a higher demand can drive prices way up.

In addition to shortages, developers have also run into problems with zoning requirements, which has significantly slowed down the construction of new homes. The issue specifically lies with single-family zoning, minimum parking, and minimum lot size requirements. As a result, fewer condominiums, mixed-use apartments, and accessory dwelling units (ADUs) have been built.

The Biden administration is encouraging local governments to initiate zoning reforms. This is projected to increase the housing supply through the construction of ADUs, estimated to be about 1 million new ADUs as a result of these reforms within the next few years. Because the federal government can’t control state and local government when it comes to land use, the White House has taken a different approach by incentivizing zoning reforms at the local level.

Limiting Investor Purchases of Foreclosed Properties

The number of investor-owned homes has dramatically increased over the last few years. In fact, in the third quarter of 2021 alone, one-fourth of all home purchases were made by corporations. While there is nothing inherently wrong with this, it does have a sizable impact on the housing market.

Once a corporation successfully purchases a home, it will usually turn it into a source of income, i.e. a rental home. As one more home is taken off the market, homebuyers are left with fewer options. This can then cause home prices to hike up in an artificial way. Homeowners associations, in particular, have encountered problems with corporation-owned homes. Because these corporations can afford to buy homes in bulk, they end up owning a large portion of the community. This can affect everything from board elections to policy resolutions.

The Neighborhood Homes Investment Act

One way corporations rack up a sizable portfolio of homes is by targeting foreclosed properties. The Neighborhood Homes Investment Act aims to fix this. The White House will require federal housing agencies to offer foreclosed properties to buyers who will actually use the home as their primary place of residence before allowing corporate buyers to put their bids in. It will also require the same housing agencies to prioritize the sale of foreclosed properties to non-profit organizations that will rehabilitate the homes over large investors.

Additionally, the Act will provide a Biden housing tax credit as well for those willing to buy homes that need rehabilitation. The Biden housing credit will hopefully encourage more people to purchase older homes. It also increases the supply of available homes as well as makes homeownership more affordable for low- to moderate-income families.

The Future of Housing

Bidens housing plan details several legislative and administrative actions that will help revitalize the housing market in the United States. For homeowners associations, it means looking forward to the preservation of existing housing, zoning reforms, and fewer large-scale investors buying up homes.

Managing a homeowners association does not come easy. If you’re on the hunt for the best HOA management company in your area, start your search using our comprehensive online directory.

RELATED ARTICLES:

Trending Now

Related Article

Sign up for Our Monthly Newsletter

Sign up below for monthly updates on all HOA Resource